AMC Networks Inc. (NASDAQ:AMCX – Get Free Report) crossed above its 200-day moving average during trading on Wednesday . The stock has a 200-day moving average of $6.61 and traded as high as $8.11. AMC Networks shares last traded at $8.08, with a volume of 236,352 shares traded.

AMC Networks Inc. (NASDAQ:AMCX – Get Free Report) crossed above its 200-day moving average during trading on Wednesday . The stock has a 200-day moving average of $6.61 and traded as high as $8.11. AMC Networks shares last traded at $8.08, with a volume of 236,352 shares traded.

Analysts Set New Price Targets

Separately, Wells Fargo & Company reissued an “underweight” rating on shares of AMC Networks in a research note on Sunday, August 10th. One equities research analyst has rated the stock with a Strong Buy rating and four have issued a Sell rating to the stock. According to data from MarketBeat.com, AMC Networks currently has a consensus rating of “Reduce” and an average target price of $5.38.

View Our Latest Research Report on AMCX

AMC Networks Stock Performance

AMC Networks (NASDAQ:AMCX – Get Free Report) last issued its quarterly earnings results on Friday, August 8th. The company reported $0.69 earnings per share for the quarter, topping the consensus estimate of $0.54 by $0.15. AMC Networks had a positive return on equity of 15.73% and a negative net margin of 7.42%.The firm had revenue of $600.02 million for the quarter, compared to the consensus estimate of $582.99 million. During the same period in the prior year, the business posted $1.24 earnings per share. The company’s revenue for the quarter was down 4.1% on a year-over-year basis. AMC Networks has set its FY 2025 guidance at EPS. Research analysts expect that AMC Networks Inc. will post 2.62 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the stock. Hsbc Holdings PLC increased its stake in AMC Networks by 10.8% in the 1st quarter. Hsbc Holdings PLC now owns 17,178 shares of the company’s stock worth $120,000 after buying an additional 1,674 shares during the period. Man Group plc increased its holdings in shares of AMC Networks by 6.7% in the 2nd quarter. Man Group plc now owns 27,669 shares of the company’s stock valued at $173,000 after acquiring an additional 1,735 shares during the period. CWM LLC grew its stake in AMC Networks by 50.4% in the second quarter. CWM LLC now owns 5,695 shares of the company’s stock valued at $36,000 after purchasing an additional 1,909 shares during the last quarter. Quantinno Capital Management LP grew its stake in AMC Networks by 20.7% in the fourth quarter. Quantinno Capital Management LP now owns 12,255 shares of the company’s stock valued at $121,000 after purchasing an additional 2,102 shares during the last quarter. Finally, Gabelli Funds LLC grew its stake in AMC Networks by 1.6% in the first quarter. Gabelli Funds LLC now owns 136,000 shares of the company’s stock valued at $936,000 after purchasing an additional 2,200 shares during the last quarter. Hedge funds and other institutional investors own 78.51% of the company’s stock.

AMC Networks Company Profile

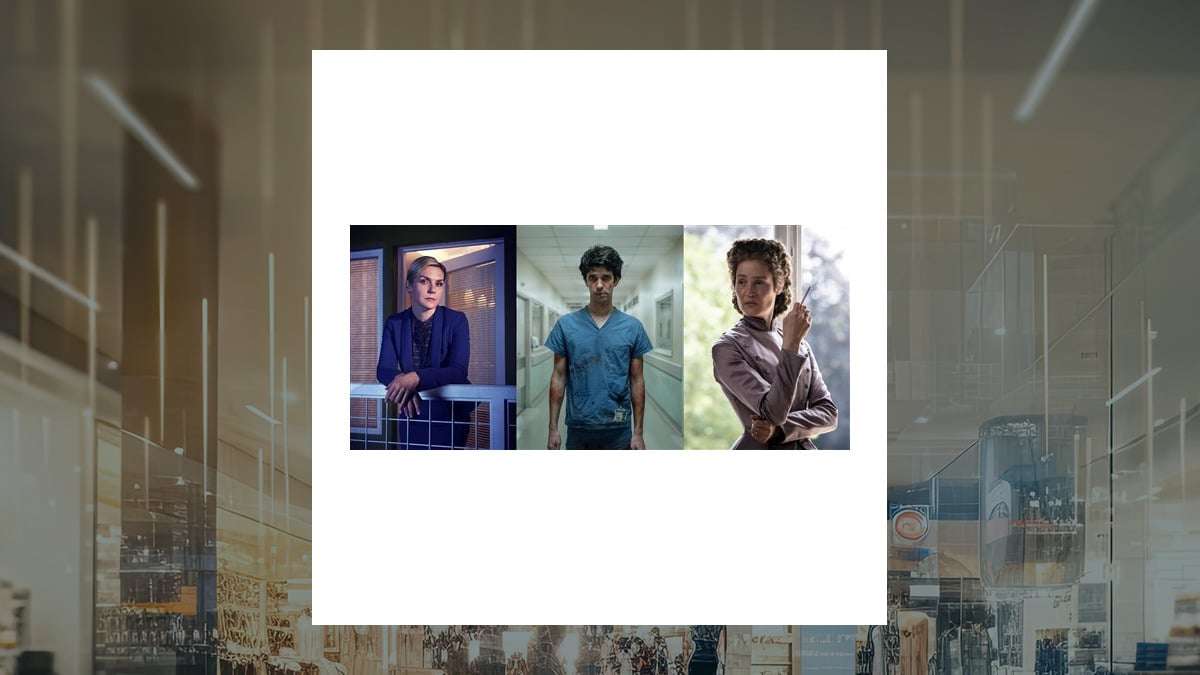

AMC Networks Inc, an entertainment company, owns and operates a suite of video entertainment products that are delivered to audiences, a platform to distributors, and advertisers in the United States, Europe, and internationally. The company operates through Domestic Operations, and International and Other segments.

See Also

- Five stocks we like better than AMC Networks

- What Percentage Gainers Tell Investors and Why They Don’t Tell the Whole Story

- Cybersecurity Market Set to Double: This ETF Offers Exposure

- How to start investing in penny stocks

- Downgraded But Not Done: 3 Stocks Ready for a Market Comeback

- How to Invest in the FAANG Stocks

- Solana Beat BTC and ETH in Q3: These 3 Stocks Saw It Coming

Receive News & Ratings for AMC Networks Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for AMC Networks and related companies with MarketBeat.com's FREE daily email newsletter.